Swiss Three Asset Management is 100% independent and has no conflicts of interest. Our recommendations are always aimed at the benefit of our customers. We also invest ourselves in the investments we recommend to our customers.

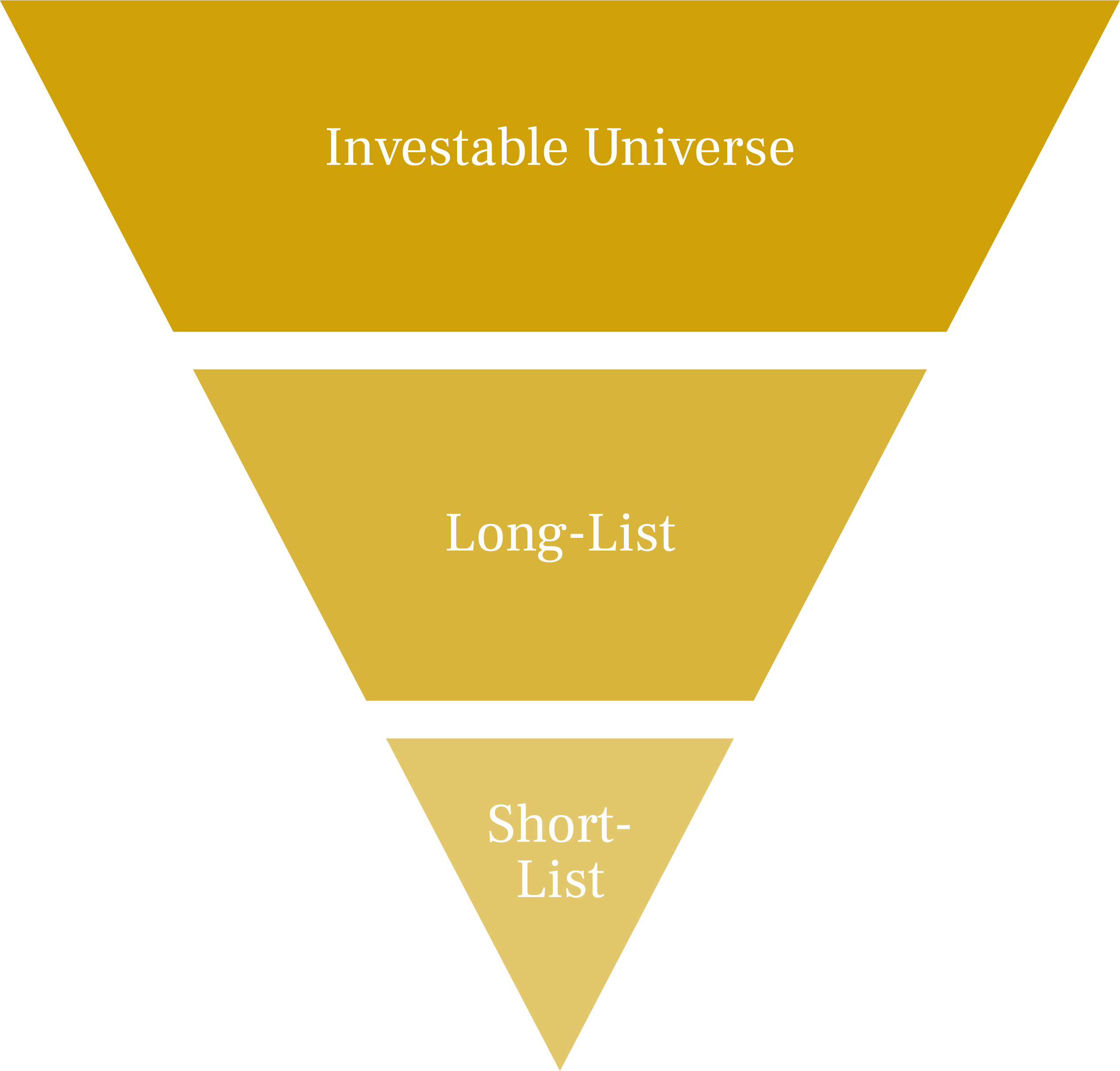

We select the best portfolio managers for our customers. These are well-known investment houses on the one hand, and specialised niche providers on the other. We continually monitor our fund universe. We carry out qualitative and quantitative analyses regularly. We constantly check that the funds correspond to our values and goals.

External databases: Morningstar, Citywire, etc.

Network: International partners

Quantitative analyses: Cross-comparison with other funds, consistent performance management and correlation.

Qualitative analyses: Competitive advantage, experience, investment process and risk management.

Monthly report From the custody banks.

Regular news about funds: Research, monthly reports, presentations, conference calls and meetings.

Absolute return funds aim for returns which are independent of the market. Thanks to the significant use of absolute return funds, we strive for stable positive asset growth, reduce the overall volatility of the portfolio and limit the market risk, regardless of whether the markets are moving up, down, or sideways.

Diversifying your assets across asset classes and fund managers is very important in order to successfully achieve your investment goals. We create balanced portfolios in which some of your assets are used for higher risk investments, and others for lower risk and stable return investments. This balance will help you achieve more stable growth over time.

We regularly check compliance with the investment guidelines of the investment strategies. We measure and monitor the risk of your portfolio with quantitative key figures. Our particular strength lies in the portfolio construction of investment portfolios with attractive returns, low volatility, relatively low drawdowns and high Sharpe ratios.

We are happy to try to resolve your questions here. If you cannot find a suitable answer to your specific question, contact us – we will be happy to help you without any obligation.

The minimum investment depends on the complexity of the account to be opened from a minimum investment of CHF 500,000.

Swiss Three Asset Management charges a management fee as well as a performance fee.

In addition, the custodian bank charges a custody account fee to safekeep the securities and transaction fees for buying and selling securities.

For private individuals we need a valid passport, a CV and proof of residence (e.g. Utility bill or bank statement). For corporate customers, we need company documents, e.g. An extract from the commercial register and the statutes.

After submitting the required documents, opening an account takes between 2 to 4 weeks, depending on the complexity.

We work with selected Swiss custodian banks, all of which have good to very good credit ratings.